For people who dream about being a farmer, having a farm can bring a great deal of joy. With no high quality farm fencing, it will be difficult to handle farm activities and keep livestock in check. Growing animals as well as plants call for fencing that is essential to both safeguard the animals and plants and control them properly without leading to discomfort to the people that live close to the farm. This’s because a lot of farms are extremely big and cover lots of hectares of land, making it not possible to be at all times. Using fencing throughout a number of segments of the farm may be the most effective way to control a farm effectively, see more at fence Langley Continue reading “Deciding On The Best Farm Fencing Solution”

For people who dream about being a farmer, having a farm can bring a great deal of joy. With no high quality farm fencing, it will be difficult to handle farm activities and keep livestock in check. Growing animals as well as plants call for fencing that is essential to both safeguard the animals and plants and control them properly without leading to discomfort to the people that live close to the farm. This’s because a lot of farms are extremely big and cover lots of hectares of land, making it not possible to be at all times. Using fencing throughout a number of segments of the farm may be the most effective way to control a farm effectively, see more at fence Langley Continue reading “Deciding On The Best Farm Fencing Solution”

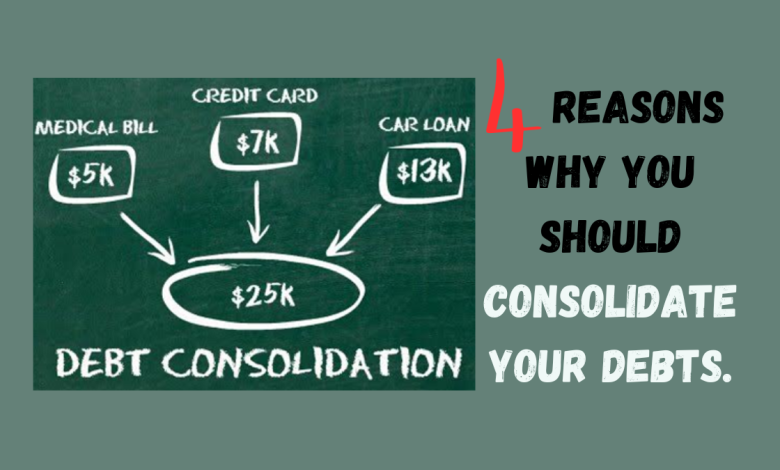

Americans that are in debt suffer from a number of effects. While several of these effects are actually small and don’t do any serious damage to customers, a lot of them can in fact wreck a person’s life. Simply several of the unwanted effects of debt are depression, despair, shame, embarrassment, and anxiety , which usually lead to more complex as well as severe issues like foreclosure, suicide, theft, divorce, bankruptcy, and murder. Due to this particular, an increasing number of Americans are attempting to discover how you can stay away from debt, and apply for some sort of

Americans that are in debt suffer from a number of effects. While several of these effects are actually small and don’t do any serious damage to customers, a lot of them can in fact wreck a person’s life. Simply several of the unwanted effects of debt are depression, despair, shame, embarrassment, and anxiety , which usually lead to more complex as well as severe issues like foreclosure, suicide, theft, divorce, bankruptcy, and murder. Due to this particular, an increasing number of Americans are attempting to discover how you can stay away from debt, and apply for some sort of

Foremost and first, give the lawyer of yours the entire Story – Once you hire your lawyer, explain to him or perhaps her every little thing that’s connected to the case of yours as well as provide him or perhaps her with every relevant document, even those details and facts that you think are harmful to your case. Lawyers have been taught to sift and sort through the info you provide as well as figure out what info is beneficial for the case of yours and what is not. Every detail and fact can be crucial to the case of yours. Facts which might not seem important to you might have severe legal consequences. The lawyer of yours may have the ability to use a point or perhaps a document you thought was unimportant as the grounds for an innovative legal argument. Of course, if something can harm the case of yours, the lawyer of yours is going to have sufficient time to make defensive maneuvers.

Foremost and first, give the lawyer of yours the entire Story – Once you hire your lawyer, explain to him or perhaps her every little thing that’s connected to the case of yours as well as provide him or perhaps her with every relevant document, even those details and facts that you think are harmful to your case. Lawyers have been taught to sift and sort through the info you provide as well as figure out what info is beneficial for the case of yours and what is not. Every detail and fact can be crucial to the case of yours. Facts which might not seem important to you might have severe legal consequences. The lawyer of yours may have the ability to use a point or perhaps a document you thought was unimportant as the grounds for an innovative legal argument. Of course, if something can harm the case of yours, the lawyer of yours is going to have sufficient time to make defensive maneuvers.

Individuals have to recognize the advantages of these budgeting software’s. You are able to find lots of reliable and efficient products online. They’re offered at very inexpensive rates. You can actually plan the monthly budget of yours by utilizing these house budget software’s for just five minutes one day. If you live by yourself you could choose personal budget software to help you monitor the expenses of yours. These products are going to make your month budgeting a reliable and quick process. You won’t have to waste extra time on creating the own spread sheets of yours. It is generally a great start to prepare a house budget by yourself however these software’s help streamline the procedure when you are

Individuals have to recognize the advantages of these budgeting software’s. You are able to find lots of reliable and efficient products online. They’re offered at very inexpensive rates. You can actually plan the monthly budget of yours by utilizing these house budget software’s for just five minutes one day. If you live by yourself you could choose personal budget software to help you monitor the expenses of yours. These products are going to make your month budgeting a reliable and quick process. You won’t have to waste extra time on creating the own spread sheets of yours. It is generally a great start to prepare a house budget by yourself however these software’s help streamline the procedure when you are